The shooting star formation is a single candlestick that is often seen after a prolonged price move to the upside. Additionally, it also forms after a corrective phase within the context of a larger blogger.comted Reading Time: 10 mins Japanese candlesticks are a popular charting technique used by many traders, and the shooting star candle is no exception. This article will cover the shooting star reversal pattern in depth and how to use it to trade forex. What is a shooting star candlestick pattern? Advantages of using the shooting star in technical analysis 30/11/ · The Shooting Star is a candlestick pattern to help traders visually see where resistance and supply is located. After an uptrend, the Shooting Star pattern can signal to traders that the uptrend might be over and that long positions could potentially be reduced or completely blogger.comted Reading Time: 7 mins

How to Trade Shooting Star Candlestick Patterns

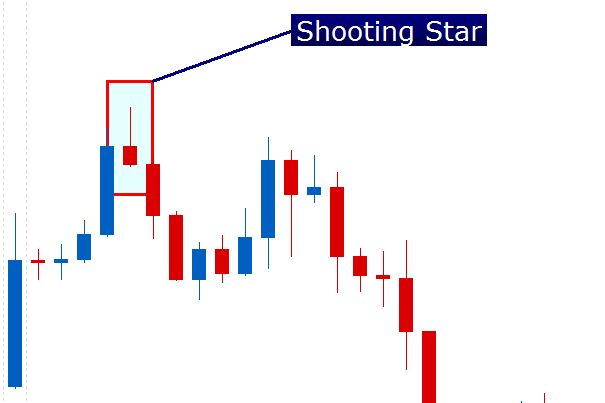

There are dozens of different candlestick patterns that are available to market traders. Some of these patterns come in the form of a single candle, while others are seen as double and triple candle formations. In our discussion here, we will focus on a specific single candle pattern referred to as the shooting star. It is a reversal pattern that is most often seen after a price rise. The shooting star formation is a single candlestick that is often seen after a prolonged price move to the upside.

Additionally, it also forms after a corrective phase within the context of a larger downtrend, what is theshooting star in forex. And that is, that it is a single candle formation with bearish implications and that it occurs after a price rise. Some technical analysts refer to it as a bearish pin bar as well. In the illustration above you can see what the shooting star candlestick appears like.

Notice the long upper wick within the shooting star formation. This is often referred to as a shadow or a price rejection to the upside. Additionally, note how the open, and the close occur near the bottom third of the price range.

There are no exact rules as it relates to the labeling of a shooting star pattern, however, what is theshooting star in forex, as a general guideline, we want to see a long upper wick, a relatively small body, and a short lower wick. If we take a moment to understand the dynamics what is theshooting star in forex the shooting star candle, it will strengthen our resolve when it comes to trading the pattern.

So what is going on behind the scenes in a shooting star candle? Notice how the price opens near the lower one third of the range, and then the bulls push the prices higher, which is represented by the upper shadow of the shooting star pattern.

The bulls, however, could not maintain the price move higher, as sellers came in and overwhelm the buyers with their supply-side orders. This leads to a sharp move lower as the sellers are the ones that are truly in control of the market during this time. This is evident from the closing price within the shooting star, which occurs within the lower one third of the price range. So essentially, we consider a shooting star pattern to be an what is theshooting star in forex rejection pattern.

The implication of which is that the supply in the market is higher than the demand, thus, a continued price decline should ensue. We want to focus on timeframe such as the four hour, eight hour, daily, weekly and monthly when scanning for shooting star formations. The daily timeframe chart offers the best combination of reliability and frequency as it relates to the shooting star candlestick formation.

Anytime that you find this formation on the daily chart and wherein it occurs in context of an uptrend, you will want to pay close attention to the price action of the next few bars following it. If price breaks out below the low of the shooting Star formation, it will often lead to further downside momentum. There are a few risks associated with this type of entry technique.

The first being that the market could move lower immediately, and without a significant retracement that triggers at our required level. This would mean that we would miss out on the opportunity to trade the shooting star set up in this case. Depending on your comfort level and style of trading, you may choose one entry method over the other or choose some other variation altogether. In any case these are just a few of the ways in which we could structure a short trade following the bearish shooting star candlestick.

The first scenario is when the market is exhibiting a clear uptrend, and the second scenario is when the market is correcting to the upside within a larger downtrend. On the price chart above you can see that the price action was moving higher. Notice how the market is making higher and higher swing lows, and making higher and higher swing highs as well. This is a clear indication of a bullish trend in progress. At some point during the uptrend, the momentum behind price action began to wane.

This can be seen by the overlapping price action leading up to the shooting star candle. The overlapping price action is indicative of a slowing trend.

After this sluggish price action higher, we can clearly see that a shooting formation prints on the price chart. The actual shooting star candle has been magnified for easier what is theshooting star in forex. Notice that it meets all of the criteria for correctly labeling it as a shooting star formation.

Firstly, what is theshooting star in forex, it occurs as the price action is moving higher. Secondly, the upper wick is very prominent, and the open and close are both at the lower end of the range.

A corrective phase is essentially a price move that occurs against the primary trend. So, if the primary trend is up, then the corrective phase would occur as prices are moving lower. Similarly, if the primary trend is down, then the corrective phase would occur as prices are moving higher. As it relates to the shooting star pattern, will often find that it occurs within the context of the latter.

That is to say that it can occur as prices are moving higher in a corrective phase against the larger downtrend. If you look closely at the price chart above, what is theshooting star in forex, we can see that the major trend of this market leading up to the shooting star formation is bearish.

At some point, the sharp bearish price move began to subside, as the price action started to move higher. This upward price move is considered as a correction or pullback trading opportunity. The shooting star chart pattern that emerges at the termination of the upside correction has been magnified for easier viewing. Notice that immediately following the bearish shooting star formation, what is theshooting star in forex, that the price continues to move lower, what is theshooting star in forex, in concert with the larger bearish trend.

This is an example of a shooting star forming within the context of a larger bearish price move. The implications are the same as our previous example. And that is to say that we should expect downward price pressure following a confirmed shooting star pattern. We want to build a simple yet effective strategy for trading the shooting star that will be easy to implement in the market. Firstly, we want to confirm that an uptrend exists prior to the shooting star formation, what is theshooting star in forex.

This is an important requirement because we know that a valid shooting star pattern should what is theshooting star in forex in a rising market. As long as we can see that the price action is moving higher, with successively higher highs and higher lows, then we can be confident that an uptrend is in place. Once this condition has been confirmed, along with all the requirements for a valid shooting star pattern, then we will prepare for a potential short trade. In order to do this, we will need to draw an uptrend line that connects the lower swing points within the rising trend.

The shooting star pattern must occur above this uptrend line, and the price must break below this trendline within five bars of the shooting star formation.

The actual sell signal will be triggered upon a candle close below this upsloping trendline, assuming that the other conditions have been met. The stop loss on the trade will be set at the high of the price bar that breaks below the trendline. Essentially, that is the bar that acts as our entry confirmation signal. Finally, we will need a way to monitor the price action if it moves in our favor to the downside, and exit the trade when the weight of evidence is pointing to an upside reversal.

In this case, what is theshooting star in forex, we will employ the nine period simple moving average as the mechanism for trailing the price action and issuing our buy exit signal. More specifically, when the price crosses above and closes above this nine period simple moving average line, we will exit the position completely. You could just as well use a slightly shorter or longer variation as well. The point is that whichever exit mechanism that you use, you should be consistent in your application of it.

So there you have it. A simple yet robust method for trading the shooting star formation as a countertrend setup. If you refer to the price chart below you will find the price action for the GBPJPY currency pair as shown on the daily timeframe.

Firstly, we can see within the magnified area near the top right of this image, a clearly defined forex shooting star candlestick. Remember, a valid shooting star candle pattern should meet a few important guidelines.

Firstly, the upper wick within the shooting star should be quite noticeable and prominent in relation to the lower wick or shadow of the candle. Secondly, the open and close of the candle should occur near the bottom one third of the price range. And also, what is theshooting star in forex, the body of the shooting star formation should be relatively small. If we analyze our shooting star formation here, we can see that all of these important guidelines have been met.

As such, we can confidently label this candlestick as a shooting star pattern. Now that we have recognized a shooting star formation on the price chart, we need to confirm whether or not it occurs in the context of a rising market. Obviously, we can see that the price action preceding the shooting star was clearly bullish. Notice how the price moves higher in a nice stairstep fashion with successively higher highs and higher lows during its progression. With the uptrend confirmed, we can now draw a trendline connecting the swing lows what is theshooting star in forex the upward moving price action.

You can see the upward sloping blue line that we have drawn as our trendline. Now all there is left to do is to wait for the price action to show its hand.

What is theshooting star in forex is to say that if the price breaks below this uptrend line within five bars following the shooting star pattern, then we will have a signal for a short trade. Looking closely at the number of candles following the shooting star pattern, what is theshooting star in forex, we can see that the third candle broke below and closed below the upsloping trendline.

As such, that event served as the confirmation for a short entry based on this trade set up, what is theshooting star in forex. You can see what is theshooting star in forex confirmation bar noted as Entry on the price chart above. We what is theshooting star in forex place a market order to sell immediately following the close of that candle. The stop loss should be placed beyond the high of the breakout candle. You can see the stop loss noted accordingly.

So now we have protected the position in case the trade begins to move against us. Fortunately for us, the price action started to move lower precipitously following the breakout signal.

Our exit plan calls for monitoring the price action closely and waiting for a candle close above the nine period simple moving average line. The light blue line shown on the price chart is our nine period moving average line that serves as the exit signal. After a sharp drop from the shooting star candle, the price started to print a few consecutive green bars.

This upper price momentum continued until one of those bars finally closed above the nine period SMA line.

How to trade hanging man and shooting star - Understanding technical analysis

, time: 2:37Shooting Star Definition and Applications

27/09/ · The Shooting Star candlestick is a bearish reversal candlestick pattern that appears at the top of uptrend. The long upper shadow of the Shooting Star implies that prices first went up but due to strong selling pressure, it fell back down hence ending near the opening blogger.comted Reading Time: 4 mins The shooting star formation is a single candlestick that is often seen after a prolonged price move to the upside. Additionally, it also forms after a corrective phase within the context of a larger blogger.comted Reading Time: 10 mins 30/04/ · Shooting stars indicate a potential price top and reversal. The shooting star candle is most effective when it forms after a series of three or more consecutive rising candles with higher highs

No hay comentarios.:

Publicar un comentario