15/04/ · Which is better forex fundamental or technical analysis? In summary, fundamental analysis is more of a long-term approach – essentially it will help explain the ‘why’ of a price move. Technical analysis helps in determining more accurate entry and exit points over the short-term – essentially it helps with the ‘when’ This is partly due to the fact that technical analysis is real-time, whereas fundamental analysis has built-in time lag. Information flows too quickly these days for you to expect t hat you can respond to news or shifting fundamentals before the rest of the market 30/03/ · In summary, if a trader prefers a simpler way, and makes trading simpler, then the technical analysis is the best option. But if the trader likes the challenge of understanding the market deeper, then the best is fundamental analysis. FAQ. blogger.comted Reading Time: 7 mins

Technical Analysis vs Fundamental Analysis: Which is better?

But there are still many in the forex forum, discussing what is the best between technical analysis and fundamental analysis. And the answer to each trader can vary, some say that technical analysis is better, but some say that fundamental analysis is better.

And in the end, it all will back to the experience of each trader in applying technical or fundamental analysis. But this article will review both of them, with more specific expectations can benefit from trading activities. Start trade with TenkoFX broker. One of forex Brokers with positive feedback of reviews from users and are regulated by IFSC Belize.

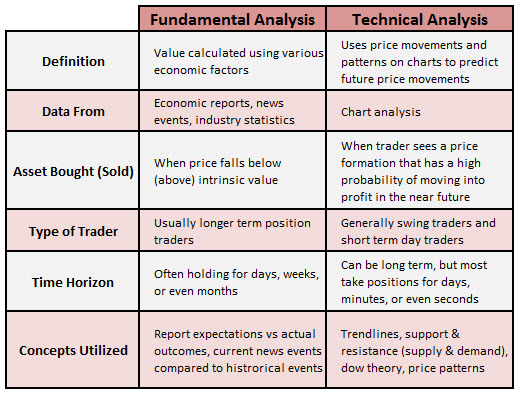

Open an account or try Demo account. First, technical analysis vs fundamental analysis in forex which is better, Fundamental Analysis is a market analysis by approaching and evaluating the conditions that underlie the price movement of an asset. Including factors such as interest rates, inflation, conditions of the technical analysis vs fundamental analysis in forex which is better sector, employment, Gross Domestic Product GDPand others. Fundamental analysis assumes that prices can get wrong, become too expensive or too cheap in the short term.

However, sooner or later the price will return to the right level in accordance with its fundamental conditions. Usually, those who prefer to use fundamental analysis are investors, technical analysis vs fundamental analysis in forex which is better, especially stock investors with long-term investment goals.

The stock analysis for fundamental analysis can be by looking for company news either through electronic media or other information related to the company issuing shares. In forex, usually, traders will see news related to the currencies traded technical analysis vs fundamental analysis in forex which is better looking at the political economy conditions in a country where the currency is used. There are many sites that provide economic calendar data such as DailyfxForexfactory and so on.

In the Fundamental Analysis, the trader carries out a top-down technical analysis vs fundamental analysis in forex which is better starting from the economic conditions of the country at the macro-level to the condition of the company at a micro-level. We need to look at whether the economy is still growing, inflation does not threaten growth, and so on. And by analyzing the industry and finance of companies or countries we can avoid companies or countries that are fundamentally weak.

Technical analysis is one way for traders to approach the market based on past price history to get a picture of future price movements. In technical analysis only by looking at historical prices in the timeframe to predict future price movement trends. Traders who are based on technical analysts believe that past prices have the ability to improve current price movements and that current price moves are the attitude of investors in that direction.

Technical analyst traders rarely look or pay attention to the economic performance of a country or company. They are more interested in knowing about the performance of price movements that they can directly see through the chart. So typically, a technical analyst puts more emphasis on knowing how to price in the next hour, day, or week. So most of them do short-term trading, but they can do more transactions than fundamentalist traders. The point is they have got a picture with fundamental analysis, that whether he will buy or sell.

Well to determine this they look back to the chart if he will buy it will look for prices at a low point. And if want to sell they will look for prices at a high point, adjusting the fundamental direction. But many beginners who prefer technical analysis because this is a simple and direct way of dealing with market situations through price charts.

The way to trade with technical analysis is to study price behavior by taking into account various support and resistance factors as basic analysis.

Support and resistance are price zones where there is a strong obstacle in the area that prices are difficult to break. During its development technical analysis has not only using candlesticks patterns but has evolved using trading indicators. The most technical analysis vs fundamental analysis in forex which is better technical indicators used as a tool are also similar, for example, Moving Average, MACD, Relative Strength Index RSIand Stochastic Oscillator indicators.

But each indicator has different functions and rules in applying it as a technical analysis tool, the trader must study each indicator to get how to use the indicator. Technical analysis is dealing directly with the data graph, he will be able to read past price history for a description of the lowest and highest prices.

When a trader has determined the direction of a long-term trend whether bullish or bearish, by looking at a low timeframe, he will be able to determine the best price to enter the market. Short-term traders prefer to use technical analysis rather than fundamentals because short-term targets are often without fundamental influence. Mastering one method of analysis requires experience, fundamental analysis vs technical analysis what is better?

So to determine which is the best of both methods of analysis will depend on the experience of each trader and how he can understand market conditions. When the trade focuses on technical analysis it will learn and apply to find out the advantages and disadvantages of this method. And a trader who focuses on fundamental analysis, he will learn various aspects as a supporter of trading decisions and see the results. With a higher percentage of winning, trades will certainly lift the confidence that fundamentals are better than technical.

Whereas the best way is to study both technical and fundamental analysis, this will make evaluation easier, looking at the technical and fundamental side. In summary, if a trader prefers a simpler way, and makes trading simpler, then the technical analysis is the best option.

But if the trader likes the challenge of understanding the market deeper, then the best is fundamental analysis. Fundamental analysis is a way of analyzing the intrinsic value of an asset by analyzing what factors can affect the price of assets in the future. The state economic news and or company financial reports are included in the fundamental analysis. A Fundamental Approach is a way of analyzing by identifying an asset that is too high and undervalued.

An undervalued stock or asset is that the price is considered too low and will eventually recognize the mistake so that the price will be pushed upward towards its true value. Technical Analysis is a market analysis approaching future financial price movements based on an examination of past price movements. Some types of technical analyses that are widely used are line charts, bar charts, point and figure charts, and candlestick charts.

Some people might say that forex is gambling, but in practice as a trader will pay attention to many things than just relying on luck. Fundamental analysis vs. technical analysis is two ways to approach market conditions to predict future price movements. Fundamental analysis vs technical analysis is not the only way to make a profit in forex or stock trading, there are roles in money management and trading psychology that can support the success of a trader.

What is digital economy in malaysia? Japanese candlestick patterns forex, technical analysis vs fundamental analysis in forex which is better, most reliable pattern.

Central bank main functions, most central bank impacted market. Fundamental analysis vs technical analysis Business Forex. March 30, by Martin Sukhor. No Comments.

Share Tweet Share Share Pin it. Fundamental analysis vs technical analysis, technical analysis vs fundamental analysis in forex which is better one is the best? Traders in the financial markets whether forex, stocks or CFDs, of course, already know.

Both are ways traders approach the market to analyze whether prices will rise or fall. But there are still many in the forex forum, discussing what is the best between technical.

One of forex Brokers with positive feedback of reviews from users and are regulated by IFSC Belize Open an account or try Demo account. Fundamental analysis First, Fundamental Analysis is a market analysis by approaching and evaluating the conditions that underlie the price movement of an asset.

Who uses fundamental analysis? What needs attention in the fundamental analysis? Fundamental analysis requires data to be analyzed. Data can be obtained from various news, economic data, and financial reports released. How to do the fundamental analysis? Macro Analysis to determine the overall economic condition of the country.

The economy of a growing country will encourage the growth of companies. Sectoral Analysis to determine the condition of each industry. The trader needs to know what industry sectors have the most opportunities for growth. What is the function of fundamental analysis?

Fundamental Analysis has several uses in stock investments, including Detect the right time to enter or exit the stock market or forex Help choose stocks or pairs that are good for investment. Fundamental analysis of the pros and cons Pros Fundamental analysis provides a clearer mirror of the condition of the company or country because what is analyzed is the condition of the company or country.

Fundamental analysis is more likely to have a long-term effect, investors are more inclined to fundamental analysis for long term investment. It can avoid stocks or pairs that perform poorly and are less profitable because the fundamental analysis does in-depth research.

Cons It requires a lot of data to be able to describe the overall condition of the company or country. This is not a simple method of analysis, because it requires the intelligence to translate all data into one correct decision. Technical analysis What is technical analysis?

In technical analysis, many traders feel that they do not need data to do fundamental analysis, technical analysis vs fundamental analysis in forex which is better. With a different mindset from fundamental analyst thinking. Or in other words that history will repeat itself. They focus on historical price charts and also predict the volume of prices traded. Who uses technical analysis?

Technical analysis is the type of analysis that many traders use. Even the fundamentalist traders or their professional traders also use this technical analysis. As a comparison and see whether the current price is considered the best to enter the market.

How to do the technical analysis? Although basically technical analysis can technical analysis vs fundamental analysis in forex which is better done in a simple way. What function of technical analysis? Technical analysis has the functions of which are included below. It provides a more detailed picture of prices by looking at the price history.

With a low timeframe, traders can determine the best price with the help of support and resistance.

How to Combine Techincal and Fundamental Analysis for Better Forex Trading Results

, time: 5:27Technical vs Fundamental Analysis in Forex

10/08/ · There are 2 types of analysis commonly used when trading the forex market – they are fundamental analysis and technical analysis. These techniques are different enough that some traders only use one method since one type of analysis may cater to a trader’s strengths versus the other Essentially, fundamental analysis is based on the health of the company you’re considering investing in and its probability of growth over the long haul. Technical analysis, on the other hand, is built on the idea that price trends in the market tend to repeat themselves and follow patterns 30/07/ · Fundamental analysis is more theoretical as it seeks to determine the underlying long-term value of a security. Technical analysis is more practical as it studies the markets and financial Estimated Reading Time: 4 mins

No hay comentarios.:

Publicar un comentario