19/06/ · Sell Limit – Order to go short at a level higher than current market price. Buy Stop – Order to go long at a level higher than current market price. Sell Stop – Order to go short at a level lower than market price. – Next, enter the price you want to enter. – Enter the Estimated Reading Time: 4 mins 27/08/ · Buy Limit Order is placed below the current market price But if the market is going in just one direction and you see a level after which market will definitely go up without any hurdle in between unless something unusual happens then you place your buy stop there. A Buy Stop Order is placed above the current market price. SELL LIMIT vs SELL STOP 16/08/ · A limit order is a market order that includes special instructions preventing it from being executed until the market price reaches the price you specify whe Author: OANDA

How to Place Limit Orders and Stop Orders in Forex – Learning FX

The high amounts of leverage commonly found in the forex market can offer investors the potential to make big gains, but also to suffer large losses. For this reason, how to place limit orders in forex, investors should employ an effective trading strategy that includes both stop and limit orders to manage their positions. Stop and limit orders in the forex market are essentially used the same way as investors use them in the stock market.

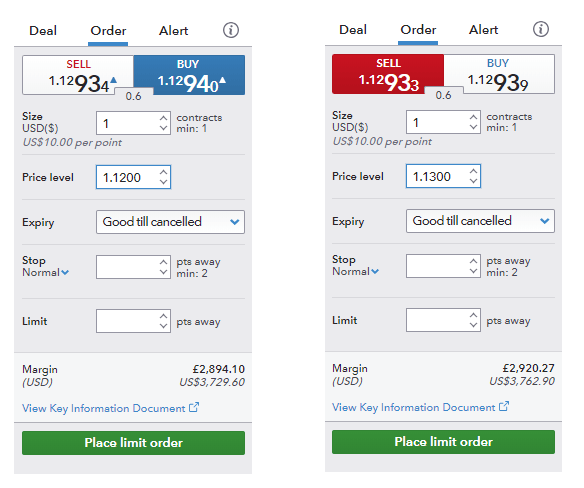

A limit order allows an investor to set the minimum or maximum price at which they would like to buy or sell, while a stop order allows an investor to specify the particular price at which they would like to buy or sell. An investor with a long position can set a limit order at a price above the current market price to take profit and a stop order below the current market price to attempt to cap the loss on the position.

An investor with a short position will set a limit price below the current price as the initial target and also use a stop order above the current price to manage risk. There are no rules that regulate how investors can use stop and limit orders to manage their positions.

Deciding where to put these control orders is a personal decision because each investor has a different risk tolerance. Some investors may decide that they are willing to incur a or pip loss on their position, while other, more risk-averse investors may limit themselves to only a pip loss.

Although where an investor puts stop and limit orders is not regulated, investors how to place limit orders in forex ensure that they are not too strict with their price limitations. If the price of the orders is too tight, they will be constantly filled due to market volatility.

Stop orders should be placed at levels that allow for the price to rebound in a profitable direction while still providing protection from excessive loss. Conversely, limit or take-profit orders should not be placed so far from the current trading price that it represents an unrealistic move in the price of the currency pair. A stop order is an order that becomes a market order only how to place limit orders in forex a specified price is reached.

It how to place limit orders in forex be used to enter a new position or to exit an existing one. A buy-stop order is an instruction to buy a currency pair at the market price once the market reaches your specified price or higher; that buy price needs to be higher than the current market price.

A sell stop order is an instruction to sell the currency pair at the market price once the market reaches your specified price or lower; that sell price needs to be lower than the current market price. Stop orders are commonly used to enter a market when you trade breakouts. To trade this opinion, you can place a stop-buy order a few pips above the resistance level so that you can trade the potential upside breakout.

If the price later reaches or surpasses your specified price, this will open your long position. An entry stop order can also be used if you want to trade a downside breakout. Place a stop-sell order a few pips below the support level so that when the price reaches your specified price or goes below it, your short position will be opened.

Stop orders are used to limit your losses. Everyone has losses from time to time, but what really affects the bottom line is the size of your losses and how you manage them. Before you even enter a trade, how to place limit orders in forex, you should already have an idea of where you want to exit your position should the market turn against it. One of the most effective ways of limiting your losses is through a how to place limit orders in forex stop order, which is commonly referred to as a stop-loss.

In order to avoid the possibility of chalking up uncontrolled losses, you can place a stop-sell order at a certain price so that your position will automatically be closed out when that price is reached. A short position will have a stop-buy order instead. Stop orders can be used to protect profits. Once your trade becomes profitable, you may shift your stop-loss order in the profitable direction to protect some of your profit.

For a long position that has become very profitable, you may move your stop-sell order from the loss to the profit zone to safeguard against the chance of realizing a loss in case your trade does not reach your specified profit objective, and the market turns against your trade. Similarly, for a short position that has become very profitable, how to place limit orders in forex, you may move your stop-buy order from loss to the profit zone in order to protect your gain.

A limit order is placed when you are only willing to enter a new position or to exit a current position at a specific price or better. The order will only be filled if the market trades at that price or better. A limit-buy order is an instruction to buy the currency pair at the market price once the market reaches your specified price or lower; that price must be lower than the current market price. A limit-sell order is an instruction to sell the currency pair at the market price once the market reaches your specified price or higher; that price must be higher than the current market price.

Limit orders are commonly used to enter a market when you fade breakouts. You fade a breakout when you don't expect the currency price to break successfully past a resistance or a support level.

In other words, you expect that the currency price will bounce off the resistance to go lower or bounce off the support to go higher. To take advantage of this theory, you can place a limit-sell order a few pips below that resistance level so that your short order will be filled when the market moves up to that specified price or higher.

Besides using the limit order to go short near a resistance, you can also use this order to go long near a support level. In this case, you can place a limit-buy order a few pips above that support level so that your long order will be filled when the market moves down to that specified price or lower.

Limit orders are used to set your profit objective. Before placing your trade, you should already have an idea of where you want to take profits should the trade go your way. A limit order allows you to exit the market at your pre-set profit objective. If you long a currency pair, you will use the limit-sell order to place your profit objective. If you go short, the limit-buy order should be used to place your profit objective. Note that these orders will only accept prices in the profitable zone.

Having a firm understanding of the different types of orders will enable you to use the right tools to achieve your intentions — how you want to enter the market trade or fadeand how you are going to exit the market profit and loss. While there may be other types of orders — market, stop and limit orders are the most common.

Be comfortable using them because improper execution of orders can cost you money. Securities and Exchange Commission. Accessed June 6, Portfolio Management. Your Money. Personal Finance. Your Practice, how to place limit orders in forex. Popular Courses. Table of Contents Expand. There Are No Set Rules. Stop Order. Limit Order. Execute the Correct Orders. Key Takeaways With how to place limit orders in forex traders employing ample leverage, relatively small moves in currency markets can generate large profits or losses.

Stop and limit orders are therefore crucial strategies for forex traders to limit margin calls and take profits automatically, how to place limit orders in forex. Both stop and limit orders are flexible, with most brokerages allowing a wide range of contingencies and specifications for each order type.

Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Accounts. Advertiser Disclosure ×. The how to place limit orders in forex that appear in this table are from partnerships from which Investopedia receives compensation.

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Related Articles. Portfolio Management Determining Where to Set Your Stop-Loss, how to place limit orders in forex. Stop Order: What's the Difference? Partner Links.

Related Terms What Does Above the Market Mean? Do Not Reduce DNR Do not reduce DNR order is a trade order with a specified price that does not get adjusted when the underlying security pays a cash dividend.

What Is a Market-If-Touched MIT Order? A market-if-touched MIT order is a conditional order that becomes a market order when a security reaches a specified price. What Does "At the Lowest Possible Price" Mean? At the lowest possible price is a security trading designation instructing a broker to execute a buy order for the smallest amount that can be found.

What Is a Bracketed Sell Order? Bracketed sell order is a short sell order that is accompanied by a conditional buy order above and a buy limit order below the initial sell order. Trailing Stop Definition and Uses A trailing stop is a stop order that tracks the price of an investment vehicle as it moves in one direction, but not in the opposite direction.

About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice. Investopedia is part of the Dotdash publishing family.

Forex Trading for Beginners #6: The Different Types of Forex Orders by Rayner Teo

, time: 8:26What Are the Rules for Stop/Limit Orders in Forex?

19/06/ · Sell Limit – Order to go short at a level higher than current market price. Buy Stop – Order to go long at a level higher than current market price. Sell Stop – Order to go short at a level lower than market price. – Next, enter the price you want to enter. – Enter the Estimated Reading Time: 4 mins 27/08/ · Buy Limit Order is placed below the current market price But if the market is going in just one direction and you see a level after which market will definitely go up without any hurdle in between unless something unusual happens then you place your buy stop there. A Buy Stop Order is placed above the current market price. SELL LIMIT vs SELL STOP 16/08/ · A limit order is a market order that includes special instructions preventing it from being executed until the market price reaches the price you specify whe Author: OANDA

No hay comentarios.:

Publicar un comentario