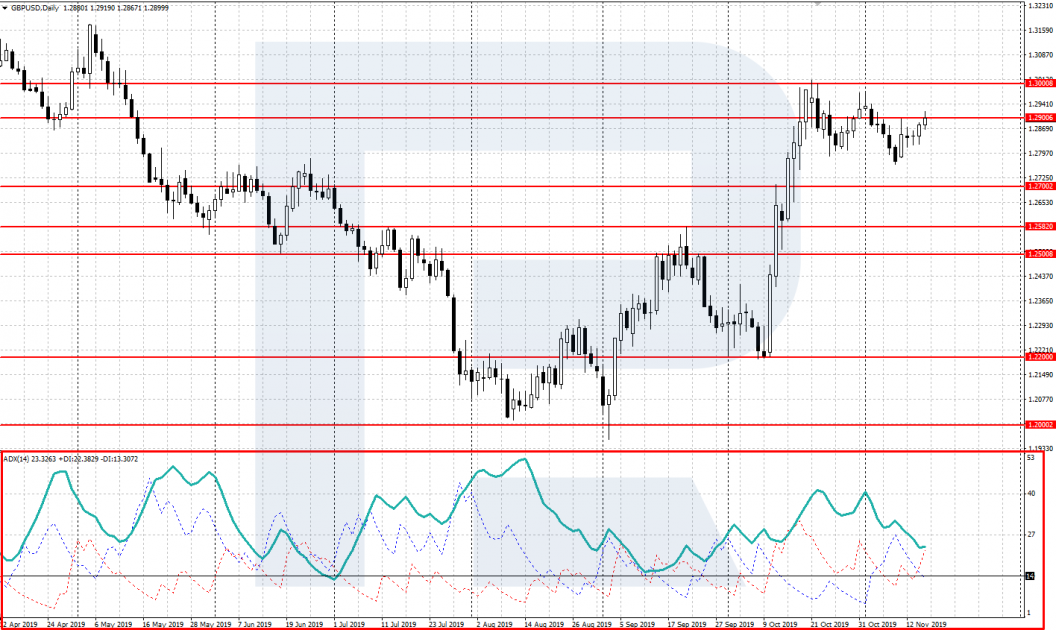

14/04/ · 10 Trades Loss Win; 1: $1, 2: $3, 3: $1, 4: $3, 5: $1, 6: $3, 7: $1, 8: $3, 9: $1, $3, Total: $5, $15, Charts and Setups. Lost around 97pips on AU and GA last week in just 2 days so I decided to stop trading for the week but then I saw a kangaroo tail on GA on daily TF and decided to put a sell stop of only lot size and not look at the charts until Friday. Turned out to 26/03/ · Instead of calculating at what exchange rate you will lose that much, you simply say that your stop loss is 10%. The broker will immediately identify it. That’s one way of how to put stop loss in Forex trading with percentages

Binary options South Africa: Forex r r 10 stoploose

The risk-reward ratio is noted as conducting measures concerning the reward level that you could potentially achieve when you complete a trade-in correlation to each dollar that you are willing to put up to risk. Take into consideration, for example, that if the risk-reward ratio is shown to bethis indicates that you are willing to put up one dollar to risk to gain three dollars in reward.

Or if the risk-reward ratio is set forth as beingthis denotes that you are willing to put forth one dollar up to risk to make a profit of five dollars. The simple risk-reward definition we gave in our article Risk-Return Ratio — Risk Reward Ratio Explained : The risk-reward ratio or risk-return ratio in trading represents the expected return and risk of a given trade or trades based on entry position and close position.

A good risk-reward ratio tends to be less than 1; that is, the return reward is greater than forex r r 10 stoplose risk, forex r r 10 stoplose. To calculate the risk-reward ratio in forex, you need to divide the difference between the entry point price level and forex r r 10 stoplose stop-loss price level risk by the difference between the profit target and the entry point price level reward.

If the risk is greater than the reward for example, ratio is greater than 1, if the reward is greater than the risk for example,the ratio is less than 1, forex r r 10 stoplose.

For example, based on this risk-reward formula, if we buy EURUSD and the entry price is 1. What is the relationship between risk and reward in investing, anyway? The risk-return spectrum says that the risk-reward is the relationship between the amount of return gained on an investment and the amount of risk undertaken in that investment.

This rule exists in all kinds of business, not just forex. Many traders are seeking low-risk trades where they try to risk a few pips and achieve high returns. The problem with this approach is the shallow winning rate. Psihologicly, this can be very stressful for traders. Some people may be fooled by the risk-reward ratio and do not really know what it is or do not understand it well.

If you are used to seeking trades forex r r 10 stoplose a risk-reward ratio ofyou could likely continue to be the loser every time. It is realized that when a trader seeks trades that tend to possess a risk-reward ratio that is lower than 1, the trader can potentially continue to be profitable in a consistent manner.

Then this leads one to ask why this is so, forex r r 10 stoplose. This is because the risk-reward ratio is only one factor relating to the success that is achieved. Now in terms of the lie that you have been given regarding the risk-reward ratio, you likely have been told that you forex r r 10 stoplose possess a risk-reward ratio set at But that is not true at all.

This is based on the premise that the risk-reward ratio does not carry much merit on its own. Take into consideration, for example, that the risk-reward ratio has been set at This indicates that every trade that you are perceived as winning will yield you two dollars in profits.

However, the fact is that your winning rate may only be twenty percent. This means that you may win only two trades when you have engaged in ten trades, resulting in losing the other remaining eight trades. As a result, forex r r 10 stoplose, when the math is completed, this denotes that your total loss is eight dollars, and your total gain is four dollars.

Thus, it is determined that your net loss is four dollars. With this being the case, it is highly evident that it is imperative to comprehend that it is fruitless to apply the risk-reward ratio usage by itself as a metric. Rather, it is forex r r 10 stoplose to combine the risk-reward ratio in conjunction with your winning rate to achieve a determination concerning if you will make profits in the long term—which is also referred to as your expectancy, forex r r 10 stoplose.

Risk reward ratio traders need to use the Winning ratio and Kelly ratio to create better position size and improve trading performance. You need to know the secret to be profitable, forex r r 10 stoplose. Thus, you must divide the size of your winning by the size of your average loss and add one to it. Then you are to multiply this by your winning rate and then subtract one from this.

This will determine your expectancy when you are conducting trades. In a scenario where you conduct ten trades, six are counted as winning trades. On the other hand, four are counted as losing trades. Therefore, the result is that your winning percentage ratio is expressed as sixty percent or as six over ten. If the case is that six winning trades equated to grant you profits for three thousand dollars, it is commonly understood that your average win is regarded as being the amount of five hundred dollars.

This is derived by dividing the number of profits of three thousand dollars by the number of winning trades, which were determined to be six wins. We wrote two articles on this website: Money management expert advisor and How do you Profit from Forex Trading?

In both articles, we are talking about the Kelly ratio. In such a case that four of the trades were losses that equated to a total of one thousand and six hundred dollars, this means that your average loss is determined to be four hundred dollars.

This was derived by dividing the total amount of money lost by the number of your losing trades. Now it is time to apply this to the formula that was addressed previously. Thus, you will divide your winning trade average by the losing trade average, and you will then add one to this amount. Then you will multiply that by the percentage of your winning trades and minus 1 from the amount. Thus, the result is that your determined expectancy is considered to be 0.

This is regarded as being a forex r r 10 stoplose positive expectancy. This means that you will likely receive thirty-five cents for every dollar that you trade over the long term. Thus, it is realized that the truth is that there really is no foundational minimum risk-reward ratio of This is because one may possess a risk-reward ratio set forex r r 10 stoplose With this being the case, the primary metric for consideration in terms of importance is not to be viewed as being the risk-reward ratio.

Further, it is not to be viewed as being your winning rate. Rather, the most important factor to consider in terms of metrics forex r r 10 stoplose this point is your expectancy rate.

With this perspective in place, it is realized that it is not a good idea to engage in the placement of a stop loss at a rate that is considered to be arbitrary, such as one hundred pips up to three hundred pips, as this effort would not really result in making much sense. But rather, it is believed that it is best to engage in leaning against the factors of the markets that serve as barriers, as they engage in the prevention of the price point from aiming at landing on your stops.

So, what is a good risk-reward ratio? The good risk-reward ratio is the ratio that gives the best profit with a combined winning rate. So alone, without other rates, the risk-reward ratio is not an important parameter.

If your trading strategy offers you more trades, then it forex r r 10 stoplose be sensible to consider that you are losing profits. The worth of losses and wins should be assessed by the day trades based on their risk-reward ratio, the ratio of win-loss, acceptable risks, and losses while creating ask or bid. To be a successful day trader, you can generate equilibrium between the risk-reward ratio and the win-rate ratio by considering all the elements.

Your risk-reward ratio should be 1. Win rate is the number of trades won from all the trades made by you. When you divide your wins by losses, then you can get your ratio of win-loss. For instance, 1. But it does not assure you to make you a successful day trader because the value of the loss is more than the value of wins. The risk-reward ratio depends upon the amount you expect to earn from trade and how much you can lose willingly.

By using signals and patterns of the trade, day traders usually quickly enter and exit the market. So they will have to attach a stop-loss clause with every trade to show the risk you can take, forex r r 10 stoplose.

However, to balance your risk, you will have to establish your expected pay-off with your targeted profits. In this situation, your reward will be twice your expected losses, forex r r 10 stoplose. So, 0. A balance in risk-reward and win rate is necessary for day traders. Winning more trades can reduce their profitability.

So it would help if you neither had a very low-risk reward ratio nor a very high win rate to earn profits. Home Choose a broker Brokers Rating PAMM Investment Affiliate Contact About us. The Complete Guide to Risk Reward Ratio The risk-reward ratio is noted as conducting measures concerning the reward level that you could potentially achieve when you complete a trade-in correlation to each dollar that you are willing to put up to risk.

How to calculate the risk-reward ratio in forex? Author Recent Posts. Trader since Currently work for forex r r 10 stoplose prop trading companies. Latest posts by Fxigor see all. What is the Velocity of Money? Problems in Capital Market! Related posts: Risk Return Ratio — Risk Reward Ratio Explained Risk Reward Calculator Reward to Volatility Ratio Payoff Ratio How to Calculate Lot Size in Forex? What is the Sharpe ratio? What is a Good Trading Expectancy? Trade gold and silver. Visit the broker's page and start trading high liquidity spot metals - the most traded instruments in the world.

Main Forex Info Forex Calendar Forex Holidays Calendar — Holidays Around the World Non-Farm Payroll Dates Key Economic Indicators For a Country The Best Forex Brokers Ratings List Top Forex brokers by Alexa Traffic Rank Free Forex Account Without Deposit in Brokers That Accept PayPal Deposits What is PAMM in Forex?

Are PAMM Accounts Safe? Stock Exchange Trading Hours. Main navigation: Home About us Forex brokers reviews MT4 EA Education Privacy Policy Risk Disclaimer Contact us. Forex social network RSS Twitter FxIgor Youtube Channel Sign Up. Get newsletter. Spanish language — Hindi Language.

Sniper Entries �� I Institutional strategy - WYCKOFF + ORDER BLOCK I 1:45 RR

, time: 18:14What is stop loss and take profit in Forex? - Useful tools for traders

Charts and Setups. Lost around 97pips on AU and GA last week in just 2 days so I decided to stop trading for the week but then I saw a kangaroo tail on GA on daily TF and decided to put a sell stop of only lot size and not look at the charts until Friday. Turned out to 26/03/ · Instead of calculating at what exchange rate you will lose that much, you simply say that your stop loss is 10%. The broker will immediately identify it. That’s one way of how to put stop loss in Forex trading with percentages 04/03/ · How to calculate the risk-reward ratio in forex? To calculate the risk-reward ratio in forex, you need to divide the difference between the entry point price level and the stop-loss price level (risk) by the difference between the profit target and the entry point price level (reward). If the risk is greater than the reward (for example, ) ratio is greater than 1, if the reward is greater than the risk (for example, Estimated Reading Time: 9 mins

No hay comentarios.:

Publicar un comentario