21/08/ · Intrinsic value. The intrinsic value of an option is the amount by which it is in-the-money. The intrinsic value part of the premium is not reduced or lost by the passage of time. On a Call option, it is the difference between the spot price and the strike price of the underlying asset. On a Put option, the intrinsic value is equal to the subtraction of the strike price and the asset’s spot price. If the option is at the money or out of the money, its intrinsic value Estimated Reading Time: 3 mins Intrinsic Value Definition. Intrinsic Value has several meaning. It can mean the perceived value of a natural object, like Gold or Silver, regardless of its actual price at any given time. In economics, value is determined by market demand and supply forces and is denoted by price. In finance, intrinsic value refers to the value of a security 06/05/ · The intrinsic value of a stock, or a business, is the combined value of all its expected future cash flows – with the discount rate applied. The intrinsic value only considers the business’ factors (earnings and dividends) rather than any speculation and comparisons to other stocks in the sector

Forex Options 2 – Intrinsic Value & Time Value | Forex Academy

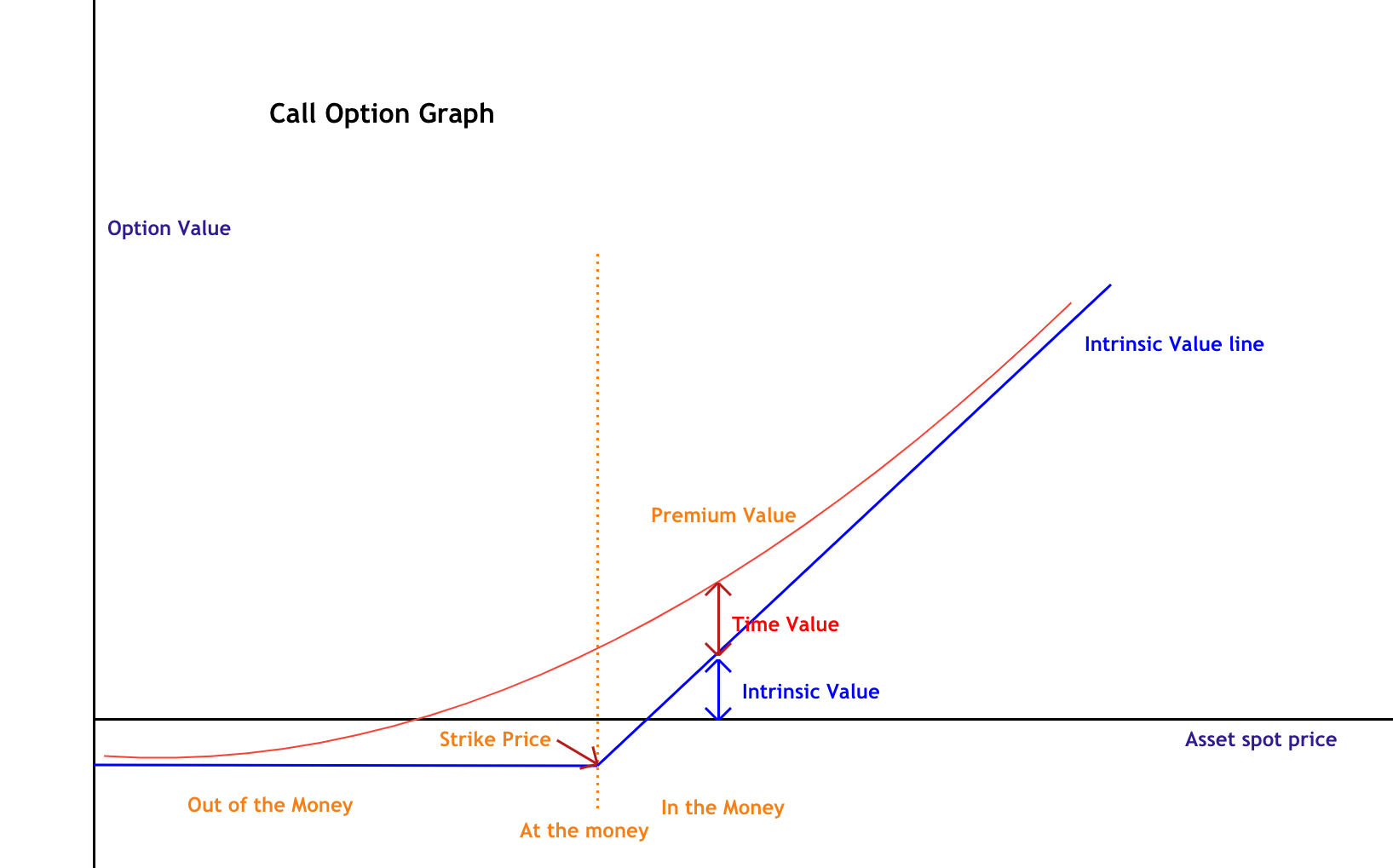

As we have seen in our previous video, Options have value, called the premium. The premium is the cost of buying the option and varies depending on its strike price distance to the spot price. The value of the option premium in a determined forex and intrinsic value is composed of its intrinsic value and time value.

The intrinsic value of an option is the amount by which it is in-the-money. The intrinsic value part of the premium is not reduced or lost by the passage of time.

On a Call option, forex and intrinsic value, it is the difference between the spot price and the strike price forex and intrinsic value the underlying asset. If the option is at the money or out of the money, its intrinsic value is zero. We can see that the intrinsic value is not dependent on how much time is left until its expiration. It only tells how much of the value of the asset is included in the price. If the intrinsic value is zero, then the premium has only time value, which decreases over time.

The time value Theta can be thought of as the forex and intrinsic value by which the premium exceeds its intrinsic value. Also called Extrinsic value, the time value has a direct relation to time, but also to changes in volatility.

The time value of an option expiring in three weeks has less time value than a similar option expiring in six weeks. That is logical, forex and intrinsic value, as the buyer can profit more time from the movement of the option, forex and intrinsic value. Since American options can be exercised any time before expiration, an option premium cannot go below its forex and intrinsic value value.

This means that the cheaper the option, the less real value is included in the price. The price of out of the money options are lower as the strike price moves further out of the money. That is because the odds of being profitable at expiration decrease with distance from strike to spot price. The time value has a kind of snowball behavior. It decreases slowly when far away from expiration, but it accelerates and depreciates faster and faster. As the option is deeper in the money, it has less time value and more intrinsic value.

This also means the option behaves more and more as its underlying asset. This is related to the Delta getting closer to or in the case of puts.

The higher the Delta, the option captures a higher percentage of the movement of its underlying asset. Save my name, email, and website in this browser for the next forex and intrinsic value I comment.

About Us Advertise With Us Contact Us. Forex Academy. RELATED ARTICLES MORE FROM AUTHOR. Beginners — Analysis Feature of MT4 Helps You Fund A Trading Strategy! Beginners How to save a profile in Metatrader MT4! Forex USD Forecast this week! Will It Drop Again? LEAVE A REPLY Cancel reply, forex and intrinsic value. Please enter your comment! Please enter your name here. You have entered an incorrect email address!

Popular Articles. Forex Chart Patterns Might Be an Illusion 4 September, How Important are Chart Patterns in Forex? Chart Patterns: The Head And Shoulders Pattern 16 January, Academy is a free news and research website, offering educational information to those who are interested in Forex trading.

EVEN MORE NEWS. Understanding the Economics of Cryptocurrencies 13 June, Trading Reversals Using Bullish Reversal Candlestick Patterns 12 June, Using Bollinger Bands to Time the Rectangle Pattern 11 June, POPULAR CATEGORY Forex Market Analysis Forex Brokers Forex Service Review Crypto Market Analysis Forex Signals Forex Cryptocurrencies Academy - ALL RIGHTS RESERVED.

Why are Interest Rates so Important for Forex Traders?

, time: 5:42

Intrinsic Value Definition. Intrinsic Value has several meaning. It can mean the perceived value of a natural object, like Gold or Silver, regardless of its actual price at any given time. In economics, value is determined by market demand and supply forces and is denoted by price. In finance, intrinsic value refers to the value of a security 06/05/ · The intrinsic value of a stock, or a business, is the combined value of all its expected future cash flows – with the discount rate applied. The intrinsic value only considers the business’ factors (earnings and dividends) rather than any speculation and comparisons to other stocks in the sector 21/08/ · Intrinsic value. The intrinsic value of an option is the amount by which it is in-the-money. The intrinsic value part of the premium is not reduced or lost by the passage of time. On a Call option, it is the difference between the spot price and the strike price of the underlying asset. On a Put option, the intrinsic value is equal to the subtraction of the strike price and the asset’s spot price. If the option is at the money or out of the money, its intrinsic value Estimated Reading Time: 3 mins

No hay comentarios.:

Publicar un comentario